With the influx of large online portals into mortgage broking and the rapid development of artificial intelligence (AI), many traditional brokers are concerned about where their industry is heading and what their role might be.

Lenders are also clearly looking for more efficient ways to deliver their service to consumers, ideally looking to save on the substantial labour cost involved in selling and processing loan products in their offering.

Whether a broker’s service is currently being delivered by a human over the phone, via face-to-face contact with the client, or delivered through some form of automated technology platform, all signs point to a digital future.

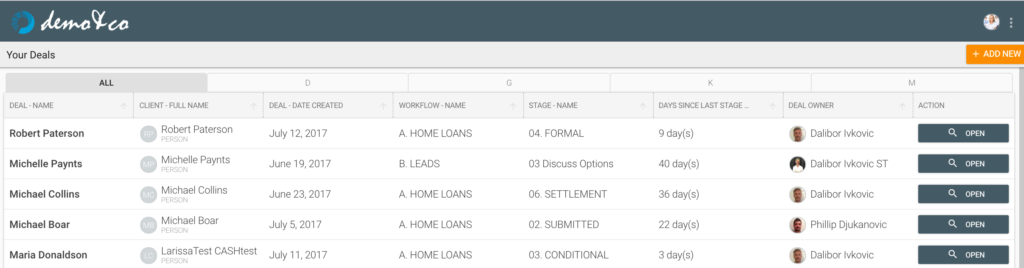

Salestrekker CRM was created with this digital transformation wholly in its sights.

Time and cost benefits

Digital technologies offer ample opportunity to automate labour-intensive processes such as data entry, document collection and travel, while simultaneously providing updates and maintaining records.

Online providers are already relying on these technologies to replace some or all of the functions of the traditional relationship broker.

While the growth of these platforms may be alarming to some, the fact is that traditional brokers have a lot to gain from using these technologies.

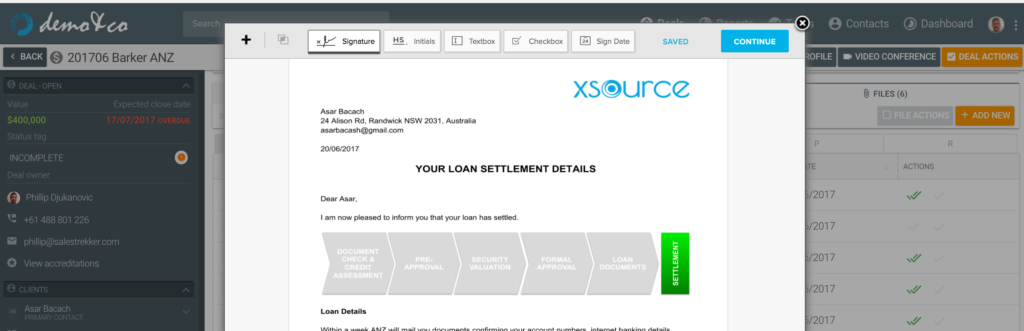

For instance, hand signing a document with a pen and paper can be time consuming and frustrating compared to getting all parties to electronically sign a document.

Providing regular updates to the client and referrer is another example. This process takes time and often distracts from other tasks that a broker is undertaking.

By contrast, brokers using the Salestrekker platform have access to email and SMS automation systems as well as client portal and partner portal functionalities that automate client and referrer updates, and most importantly, make them regular and integrated into brokers’ daily activities.

Save on travel and typing

Travel to and from client meetings is one of the key cost and time requirements in every sales job. While some clients will demand a face-to-face meeting, an efficient adviser can give the equivalent service using video conferencing such as the video conferencing tool integrated into Salestrekker’s CRM.

Another of the crucial time-saving benefits that digital technologies offer is reducing the need to type information, especially in fiddly fact find documents and application forms which often create a bottleneck in the process.

By scanning vital documents and combining optical character recognition (OCR), at the same time accessing the API interface and digital services that already contain client information, Salestrekker reduces data entry time and significantly streamlines the process.

Fraud prevention

While face-to-face judgement has long been a critical step in detecting fraud, technology can give greater certainty in fraud detection in the early stages of the finance process.

In a matter of seconds, electronic identity verification tools can:

- Scan ID documents and check their authenticity with their issuer;

- Complete a client voice and face biometric check;

- Send client data to databases to complete AML/CTF verification;

- Complete credit checks for further authentication; and

- Verify the client’s address.

Bank statement portals can also deliver original bank statements and prevent any fraudulent ‘doctoring’ of the client’s banking activity.

In the Salestrekker system, all of the verification tools listed above are integrated to perform automated checks, providing a significant protection against fraud.

Enhanced compliance

Compliance documentation requirements can weigh heavily on brokers. Salestrekker’s digital compliance system not only reduces broker workload but ensures that all the aspects of legally-required disclosure are delivered to the client in a timely manner.

Automated collection of both bank statements and data enables extensive insight into the client’s financial position, including detailed expense analysis and income verification. Using these tools brokers can deliver their advice fully understanding the client’s ability to service the debt.

Where ongoing bank feeds are arranged, the adviser can monitor the client’s ongoing financial status even after loan settlement. This not only meets compliance needs but enables a broker to provide service to the same client for all of their financial needs down the track.

Improved client satisfaction

Digital technology ultimately allows clients to be better connected with their service provider. The ease of signing documents, access to a client portal and automated systems of updates all vastly improve client satisfaction.

While human contact is absolutely critical (and the biggest advantage of using a relationship broker over an online service), technology can overcome many of the impracticalities inherent in traditional physical processes.

It’s not just online and automated brokerage services that stand to benefit using technology; there are huge advantages available to relationship brokers with the inevitable digitalisation of the finance process. Rather than avoiding broking’s digital future, brokers should embrace it fully to extend their service offering and compete on equal terms with the incoming AI and online competitors.

With the recent release of Salestrekker CRM, Australia has its first fully digitally-enabled broker platform to assist both online and relationship-based brokerages. Based 100% online, this CRM offers 24/7 customer support and onboarding to brokers throughout Australia.

The best thing about Salestrekker CRM is that it delivers the future of broking to you now. Contact us today for a 30-day free trial that will let you experience the benefits of Salestrekker’s fully automated CRM and industry-leading broker tools.